The Cap. The Census. The Exit.

Hospice valuations are complex. We navigate the Medicare Cap, Average Length of Stay (ALOS), and the 36-Month Rule to secure premium exits for agency owners.

Strictly Confidential. We understand the sensitivity of end-of-life care businesses.

We Position Your Agency for the Right Buyer

Not all hospices are the same. We categorize your business to match the investment criteria of our 500+ buyers.

The "Clean" Platform

Focus: Under the Cap + High Compliance.

Value Driver: Premium Multiples. If you have a clean survey history and are well under the Aggregate Cap, we market you as a "Flagship" acquisition to Private Equity.

The Turnaround Opportunity

Focus: Census dips or Cap issues.

Value Driver: Strategic Value. We find buyers who have "Cap Space" and can absorb your patient load to balance their own numbers, turning your liability into their asset.

The Palliative Hybrid

Focus: Pre-Hospice & Palliative Care.

Value Driver: Upstream Funnel. Buyers love the ability to capture patients earlier in the disease trajectory. We highlight your "conversion rate" from Palliative to Hospice.

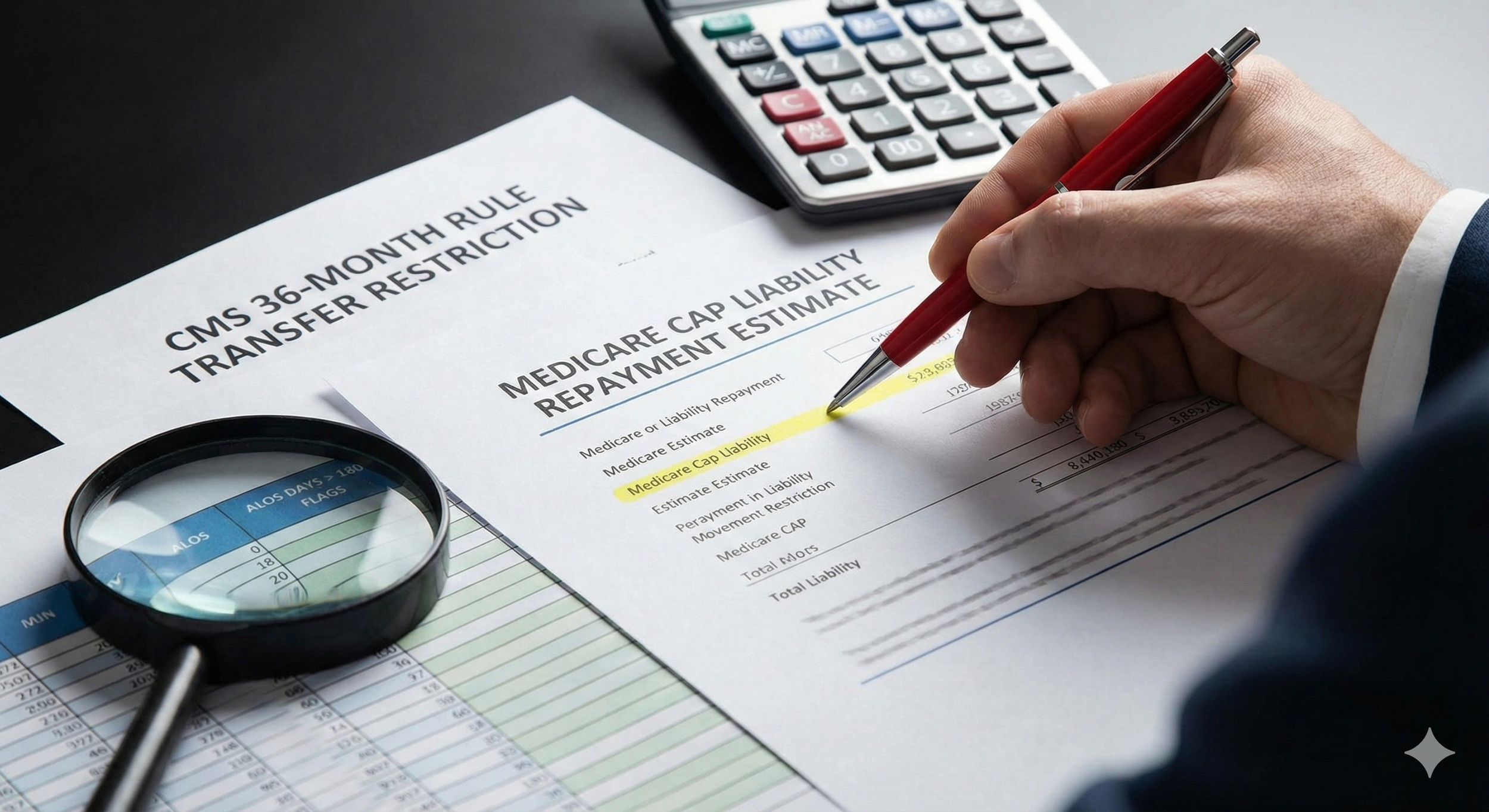

The "Deal Killers": We Solve Them Before Listing

Hospice deals often fail due to these three specific regulatory risks. We address them upfront.

The Medicare Cap Liability

The Problem: If you exceeded the Aggregate Cap (approx. $33k/patient), you owe money back to CMS. Buyers deduct this dollar-for-dollar.

The Solution: We calculate your "Cap Cushion" proactively. If there is a liability, we structure an escrow holdback so the deal can still close.

Length of Stay (ALOS) Flags

The Problem: If your ALOS is >180 days, auditors suspect "unqualified" patients.

The Solution: We audit your "Live Discharge" rates and medical eligibility documentation to build a defense file for Due Diligence.

The 36-Month Rule

The Problem: CMS prohibits the transfer of a provider number if the agency has changed majority ownership within 36 months of initial enrollment.

The Solution: We verify your enrollment date immediately. If you are in the "lockout" period, we structure an "Asset Sale" or "Management Services Agreement (MSA)" to bypass the restriction legally.

Hospice is the "Crown Jewel" of Healthcare M&A

Because of the stable, per-diem reimbursement model and the aging demographic, Hospice agencies command the highest multiples in the post-acute sector.

The Trend: Large platforms (like Amedisys, LHC Group, and PE firms) are aggressively consolidating.

The Multiple: While home care trades at 4x-6x, high-quality Hospice agencies frequently trade at 8x-12x EBITDA. The window to exit at these historical highs is open right now.

Common Questions About Selling a Hospice Agency

-

A: Hospice valuations are currently the strongest in the post-acute sector. "Platform" agencies (clean survey, $1M+ EBITDA) often command 8x–12x EBITDA. Smaller agencies ($500k EBITDA) typically trade at 5x–7x. However, these multiples rely heavily on being under the Medicare Cap.

-

A: Being "Over Cap" does not prevent a sale, but it impacts the deal structure. The repayment liability is a debt to CMS. We typically structure the deal as "Net-of-Liability," meaning the estimated repayment is deducted from the purchase price or placed in escrow until the CMS final settlement letter is received.

-

A: Unlike home care (which is often an Asset Sale), Hospice deals are frequently Stock Sales. This is because the Medicare Provider Number (PTAN) is tied to the legal entity. A Stock Sale allows the buyer to acquire the Provider Number without triggering a lengthy re-accreditation process, though it requires deeper due diligence on past liabilities.

-

A: If your agency received its initial provider number fewer than 36 months ago, you cannot simply transfer ownership. We help navigate this by structuring alternative exits, such as a Management Services Agreement (MSA) with an option to purchase once the 36-month window clears.

-

A: A Hospice sale is slower than a standard business sale due to regulatory notice periods. While the commercial closing can happen in 4–6 months, the regulatory tie-off with CMS and state agencies can extend the transition period. We manage this timeline to ensure you get paid at closing, not months later.

Ready to Secure Your Legacy?

You have served your community through their most difficult moments. Let us serve you in your exit.

Just have a quick question? Contact Us Here